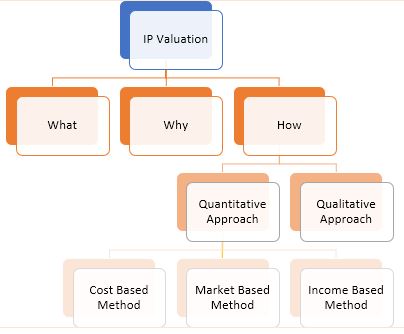

IP Valuation

Once you have a clear picture of all the IP rights (registered and unregistered, developed by you or acquired by others), it will then be time to try to assess and quantify their economic value, in terms of the current and future/potential economic benefits that can or might be derived from such rights. Such economic benefits will be linked to the capacity of your IP rights to enable you:

- To exclude competitors from a particular market for a certain time, or more generally, to raise barriers to entry into the market by potential competitors, or

- To exploit them, either directly as the owner of the IP rights concerned, or through their assignment or licensing to or by third parties.

As already mentioned, intangible assets are often the most valuable component of a company.

WHAT

In simple terms, IP valuation is a process to determine the monetary value of your IP rights. Such IP rights can sometimes be the most valuable component of a business enterprise and should not be underestimated or overlooked. Just consider the difference between the value of a bottle of dark colored liquid for consumption, with no markings on the bottle, and another bottle of the same liquid when the bottle carries the mark for Coca Cola® or Pepsi®.

WHY

IP valuation is carried out for all the same reasons why you should conduct routine IP Audits, but also in the following specific circumstances:

- You are about to enter into a contract that includes the sale, licensing or franchising of one or more IP rights.

- You are involved in a dispute or litigation that involves IP rights and you have to assess the amount of damages.

- In case of bankruptcy of a company, when it may be necessary to calculate value of all assets under liquidation, including intangible assets.

- You want to use your IPRs as collateral to obtain a loan from a bank.

- You try to attract investors and you have to prove the value and the solidity of your business.

- You are involved in a merger or acquisition, divestures, spin-offs, joint venture or strategic alliance, or donation of IP assets.

- In the context of financial reporting and taxation.

HOW

There are different modalities for carrying out an IP Valuation. The selection of the most appropriate approach will depend on a number of factors, including:

- The purpose of the valuation: for example, is it in the context of a licensing agreement, or of a bankruptcy procedure? or

- The availability and reliability of data.

Generally, intellectual property valuation approaches are classified in two categories:

- Quantitative approaches to IP valuation: as the name suggest, they rely on numerical and measurable data;

- Qualitative approaches to IP valuation: they focus instead on the analysis and consideration of other perhaps more abstract characteristics of the IP rights in questions (such as the legal strength, vulnerability to attack, geographical coverage, and suchlike).

Please refer to Section A.3 of the Handbook on IP Commercialisation to learn more about the modalities to carry out an IP valuation and on the different criteria and methods.

Next page: Using IPRs to Raise Capitals

Go to the Table of Contents